In the past two years, a certain bank's clearing center has fully implemented domestic technology, marking a significant breakthrough in the financial industry's technological innovation in China. During this process, DSG data synchronization technology has played a key role in providing strong support for the full-stack localization process of the bank's clearing center.

The clearing center of a certain line is a national financial service organization that provides payment clearing and related services to central banks, commercial banks, and the entire society. It is responsible for the construction, operation, maintenance, and management of the payment system, providing comprehensive support for large-sum fund transfers for enterprises, financial market transactions, retail payments for residents, and various payment scenarios for domestic and foreign currencies. It is an important component of China's financial infrastructure.

Background and Current Situation of the Project

In 2021, the bank implemented the full-stack domestication of IBPS Shanghai instance, with many data synchronization vendors participating in the testing. After strict selection, DSG data synchronization technology stood out and became the preferred partner for the bank's clearing center IBPS full-stack domestication.

From 2020 to 2022, DSG actively cooperated with the bank's clearing center to carry out rigorous and demanding testing and adaptation work. Ultimately, the bank's clearing center's online banking system IBPS-Shanghai instance full-stack domestication was successfully launched in November 2022 and runs stably. In June 2023, the bank's clearing center's IBPS-Beijing instance full-stack domestication and the bank's clearing center's foreign currency system-Shanghai and Beijing instance full-stack domestication were also successfully launched.

Challenges in project implementation

During the project implementation, DSG faces a series of demanding, high-standard, and challenging project challenges.

Project Challenges

Strong complexity of business systems: The project involves multiple business scenarios, including single-row insert and multi-row update scenarios, as well as scenarios where the source-side primary key does not match the target-side primary key, and vice versa.

High requirements for data synchronization timeliness: In the online banking business scenario, it involves operations such as end-of-day processing, daily closing, and daily reconciliation. Data must be synchronized to the aggregation database at a fixed time every day to ensure the accuracy and timeliness of business reconciliation.

Customized development requirements: For TDSQL secondary partition tables, sharded tables, and broadcast tables, there are issues with updating data when only one primary key is provided. Customized development is needed to implement adaptive handling methods such as alerts, updating to insertion, and ignoring issues. Also, the source database needs to support automatic adaptation to cn and dn failures.

Diverse system characteristics: The online banking system has a two-site three-center, active-active architecture, and data sources need to be distinguished using specified identifiers. The foreign exchange system has a one-site to one-site architecture, with free-format data tables requiring special handling. Each system has diverse characteristics and flexible requirements.

High availability requirements: Disaster recovery switchover for 39 synchronization links needs to be achieved within 10 minutes.

Under the multiple difficult points, DSG is brave to explore, dare to innovate, by making detailed plans, optimizing workflow, strengthening team cooperation, overcoming technical difficulties, and ensuring the successful implementation of the project.

Project technical architecture

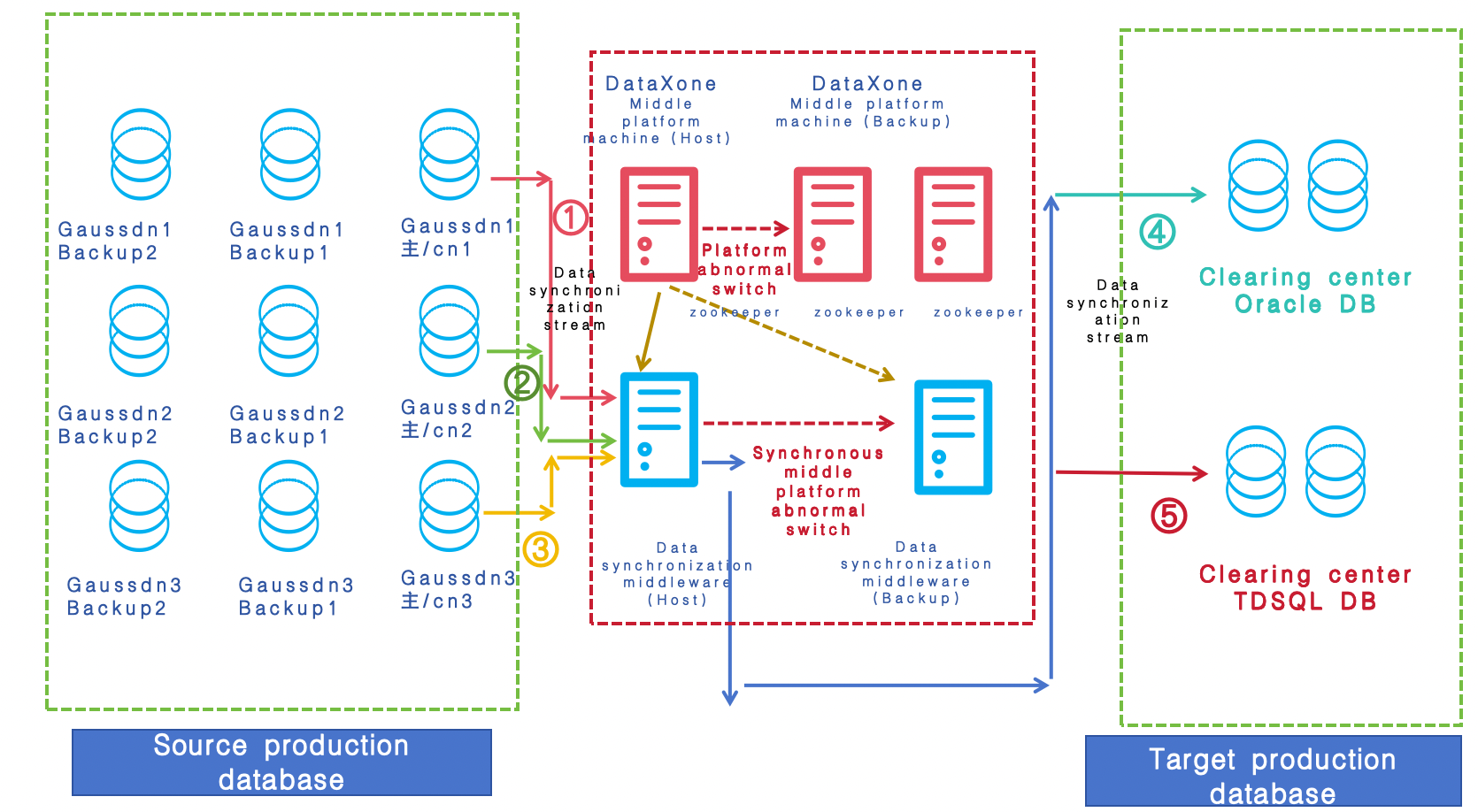

一、Technical Architecture of Online Banking System

The bank's online banking system adopts a two-site three-center architecture, using the DSG DataXone exchange integrated management platform, with GaussDB as the source database, and Oracle and TDSQL as the target databases. Data is synchronized in real-time from the two centers in Beijing and Shanghai to the three locations of Beijing, Shanghai, and Wuxi, ensuring data consistency and timeliness.

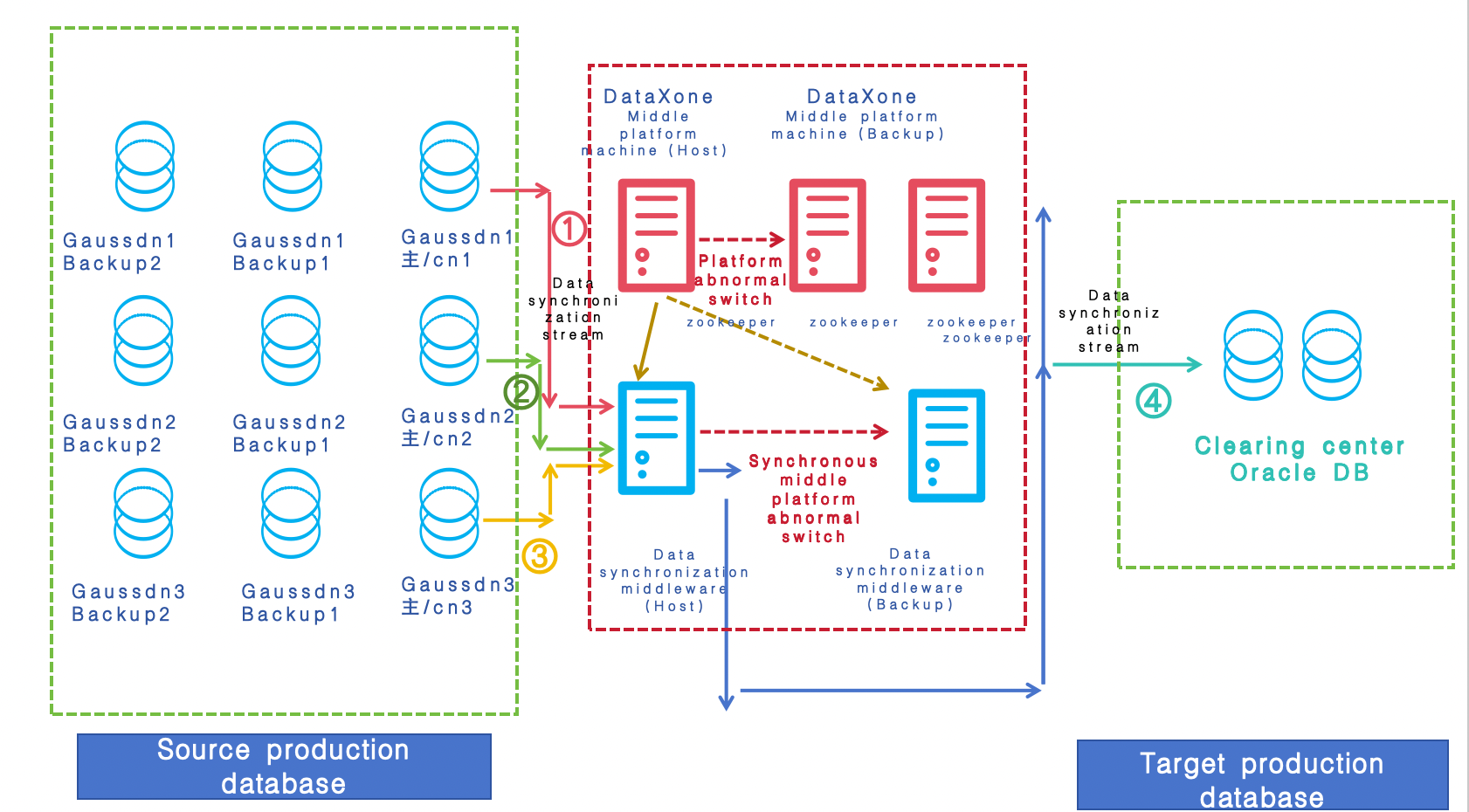

二、Technical Architecture of Foreign Currency System

The foreign currency system of the bank adopts a two-site two-center architecture. It utilizes the DSG DataXone exchange integration management platform, with GaussDB as the source database and Oracle as the target database, to ensure real-time synchronization of data between the two centers in Beijing and Shanghai, guaranteeing data consistency and timeliness.

Project Collection Requirements and Product Description

collection requirements

Product Description

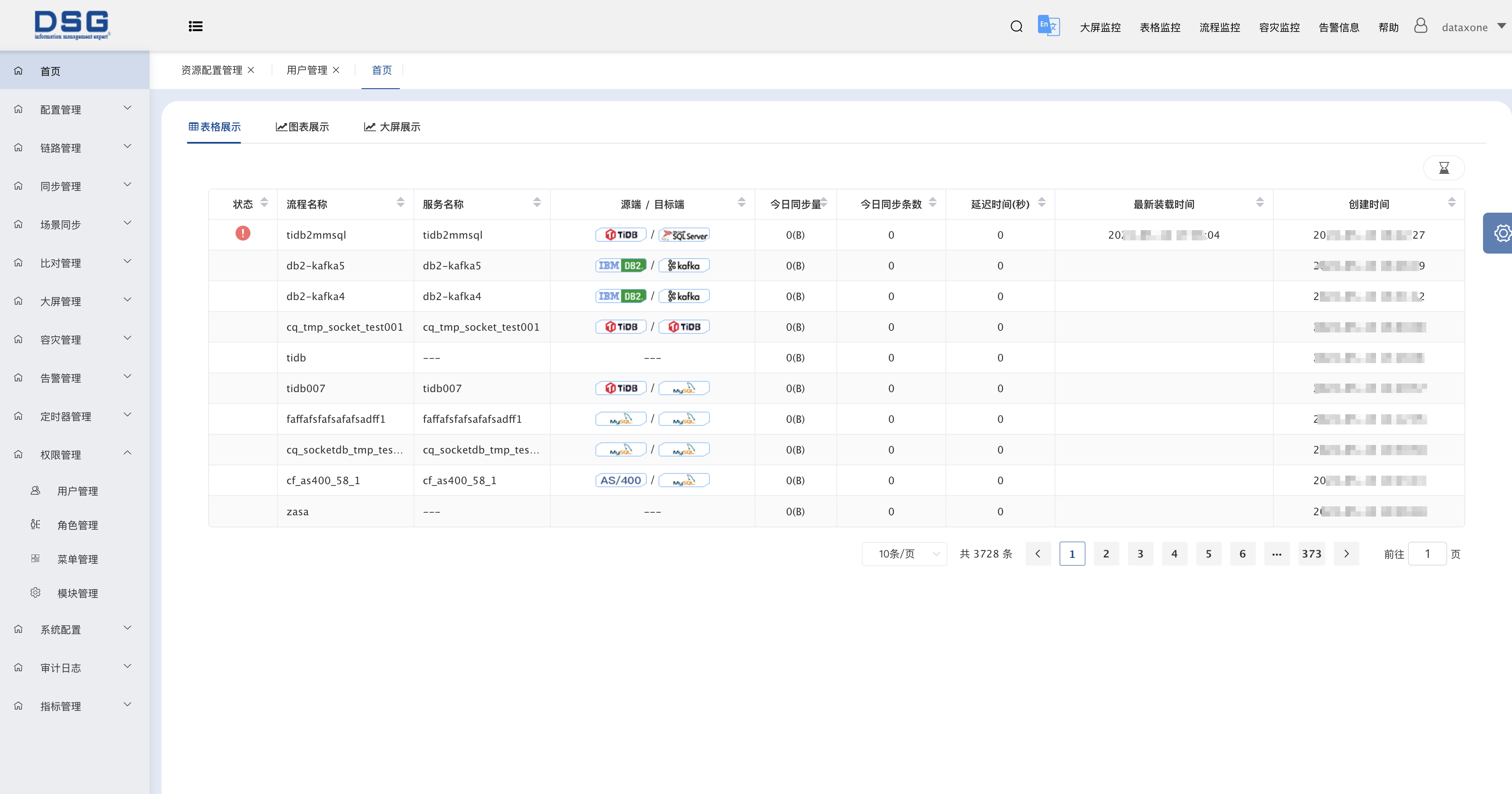

DSG DataXone Exchange Integration Management Platform is an independently developed data collection and sharing exchange platform with independent intellectual property rights by DSG. It integrates independently developed modules such as database synchronization, data transformation and desensitization, file synchronization, switch navigation, and differential comparison, enabling efficient real-time synchronization of multiple heterogeneous databases. It supports data collection, sharing, exchange, replication, migration, disaster recovery switching, and other scenario applications, compatible with more than a hundred heterogeneous source and target data sources, including domestic and foreign databases, big data platforms, cloud-based, on-premises, and intra-cloud data exchange and sharing. It is the foundational platform for enterprise group data exchange.

Visualization Interface Preview Image

Performance indicators and deployment instructions

Performance indicators

The data is synchronized in real-time at a minimum of 150 transactions per second (tps) and a maximum of 500 tps.

Deployment instructions

This time, the total center for liquidation of the bank was fully localized, adopting a middle machine deployment mode. The deployment architecture of DSG DataXone is highly available, with two DataXone main and standby servers, database master-master replication, main and standby managers, and a zookeeper cluster. The middle machine in the synchronization link consists of two machines and creates and associates a highly available host group to meet the high availability switching requirements of the synchronization link.

In the process of achieving the successful launch of the fully domesticated IBPS full-stack clearing center in Beijing and Shanghai, as well as the full-stack domestication of foreign currency systems, DSG actively collected customer requirements, progressively advanced customer needs, and actively promoted product and R&D cooperation, laying a solid foundation for the future full-stack domestication of other systems.

In conclusion, the successful launch of the full-stack domestication of the clearing center system is an important milestone in the financial industry's technological innovation. In the future, as the financial industry continues to develop, DSG will continue to help the industry achieve more innovative breakthroughs and explore the forefront of financial technology together!

2024.05.16

Learn more>

2024.04.01

Learn more>

2024.03.25

Learn more>

2024.03.18

Learn more>

2024.03.04

Learn more>

2024.02.19

Learn more>

2024.02.04

Learn more>

2024.01.22

Learn more>

2024.01.15

Learn more>

2024.01.02

Learn more>

2023.12.25

Learn more>

2023.12.20

Learn more>

2023.12.11

Learn more>

2023.12.04

Learn more>

2023.11.20

Learn more>

2023.11.13

Learn more>

2023.11.06

Learn more>

2023.10.30

Learn more>

2023.10.11

Learn more>

2023.09.15

Learn more>

2023.08.01

Learn more>

2023.07.25

Learn more>

2023.07.04

Learn more>

2023.05.29

Learn more>

2023.05.08

Learn more>

2023.03.06

Learn more>

2022.12.28

Learn more>

2022.11.14

Learn more>

2022.09.26

Learn more>