Recently, the main data center of the Agricultural Bank of China's payment clearing system completed a switchover drill, successfully migrating all online and batch transactions from the Beijing data center to the Changsha data center. After running in the Changsha data center for 2 hours and 10 minutes, the system was successfully switched back to the dual-center operation mode of Beijing and Changsha, and all business verifications were successful.

Switching practice site Source: Rural Credit Union Fund Clearing Center

Switching practice site Source: Rural Credit Union Fund Clearing CenterThe Rural Credit Union Funds Clearing Center Co., Ltd. (hereinafter referred to as the "Rural Credit Union Funds Clearing Center") is a nationwide professional licensed clearing organization that provides fund clearing services for small and medium-sized rural financial institutions nationwide. Over the years, the Rural Credit Union Center has introduced the most advanced domestic and international technology and equipment to develop fund clearing systems that adapt to the characteristics of rural finance, fundamentally improving the payment settlement environment for rural financial institutions, ensuring smooth payment channels, and enhancing the level of payment settlement services for rural financial institutions. This ultimately provides convenient and efficient financial services for agriculture, rural economies, and rural residents, playing an active role in effectively promoting the construction of a socialist new rural society.

Currently, the Rural Credit Union payment clearing system covers nearly 80,000 branches of rural credit cooperatives, rural commercial banks, rural cooperative banks, village banks, and other small and medium-sized rural financial institutions nationwide, forming a cross-province real-time payment clearing network with the influential "Rural Credit Union payment clearing" brand, which has become an important part of China's payment clearing system.

DB2, as a high-performance, highly reliable relational database management system, provides robust data management capabilities for the Rural Credit Union Funds Clearing Center. It has outstanding parallelism, scalability, and security, and supports transaction processing and large-scale data warehouse applications to handle high concurrency, high throughput, and complex query scenarios, meeting the application needs of the Rural Credit Union under different circumstances.

With the continuous development of the Agricultural Bank's fund clearing center, the trend of information explosion and data-driven requirements requires the continuous improvement of system stability and security. The center faces the problem of single point of failure, which may lead to transaction failures and business interruptions that need to be urgently resolved. Therefore, the center has chosen DB2 as the source and target database and is actively building a dual active disaster recovery system with two centers in different locations, and has proposed three major target requirements.

Disaster recovery

By using real-time synchronization, data from the remote production system is streamed and synchronized to the target system. In the event of a disaster in the production system, business operations and data recovery can be carried out using the data on the disaster recovery system.

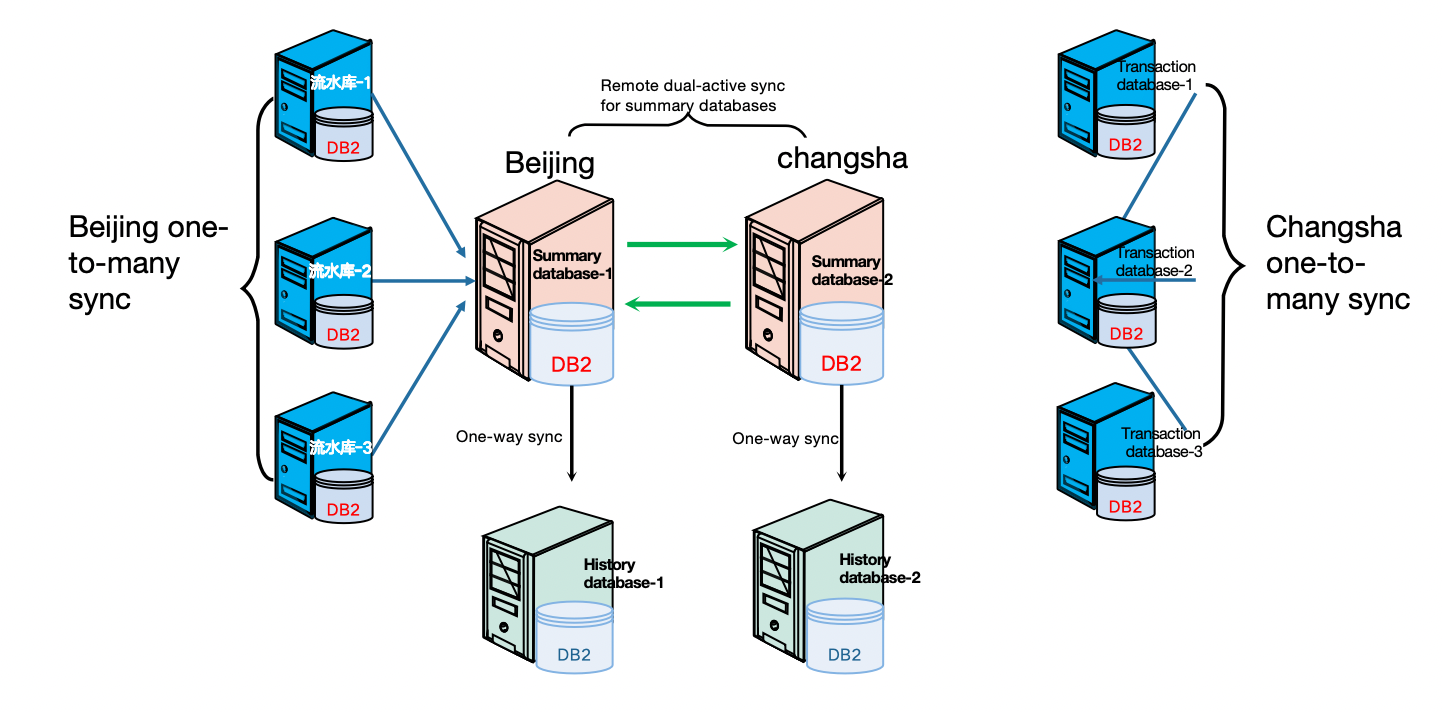

Dual Center

Real-time synchronization of data from Beijing to the Changsha data center allows the two centers to handle transactions and separate data queries, reports, and other applications from the production system in Beijing, thereby increasing system efficiency and reducing resource contention and consumption in the production system.

Sharing

The centralization of distributed system datasets onto a unified enterprise data platform allows for the sharing of local enterprise data with multiple remote users to meet their personalized data application needs.

In order to achieve the overall goal, the Agricultural Bank's funds clearing center has reached a strategic cooperation intention with DSG to use the DSG SuperSync large database high-performance replication tool to ensure the remote dual-center and dual-active disaster recovery construction of the Agricultural Bank's funds clearing center. As of now, the dual-active data synchronization of multiple core business systems in the center has been completed.

The disaster recovery construction of the NPS (payment clearing system) and NAS (inter-center clearing account system) in the NCS system group of the Agricultural Bank's funds clearing center adopts a multi-to-one, dual-active synchronization architecture. Despite many challenges, DSG has overcome numerous difficulties and achieved multiple technological innovations with its rich experience in financial IT system implementation and in-depth understanding of dual-active synchronization technology.

Many-to-one, dual active synchronous architecture

Many-to-one

Dual live

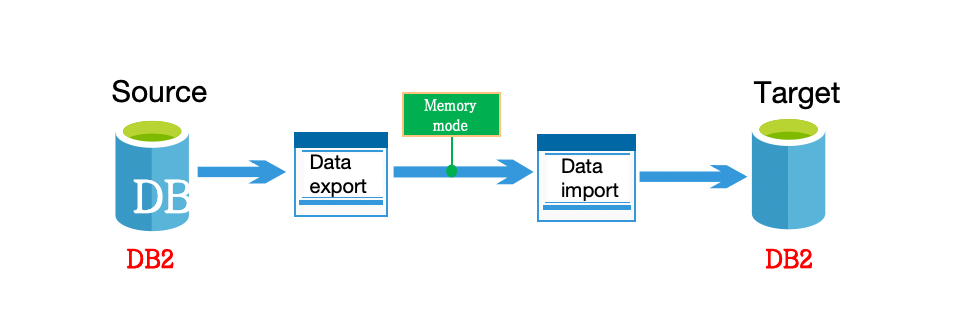

In addition, in this project, DSG software DSG SuperSync for DB2 pioneered the memory mode, where the export-side data is kept in memory and directly sent to the target side for loading, eliminating the step of writing to disk on the source side and reducing I/O calls, significantly improving synchronization performance efficiency.

Advantages of Memory Modes

Installation

Reducing program modules can help reduce the risk of program unexpected termination leading to synchronization damage.

Storage

Source-side storage requires less relative to the disk mode.

The space occupied by the source-side log is reduced.

Resource

Decreased I/O at the source end leads to reduced resource consumption.

Abnormal

Network interruption, file landing in cache.

Performance

The performance of the source end has been improved, enhancing the overall synchronization efficiency.

To ensure the security and consistency of the dual-active disaster recovery construction of the remote dual center, DSG also provides a comprehensive monitoring and comparison tool for the funds clearing center of the Agricultural Bank, including the DSG DMP disaster recovery monitoring management platform and the DSG XCMP data comparison platform. These platforms provide comprehensive monitoring of information such as data change time, data change magnitude, and software operating status, as well as improvement of the comparison and repair processes. They also timely issue abnormal alarms through multiple channels to improve work efficiency and operational benefits.

About DSG DMP and DSG XCMP

DSG DMP Disaster Recovery Monitoring Management Platform is a high-performance, large-scale database monitoring platform tool with independent intellectual property rights developed by DSG. It provides a visual monitoring interface to track data synchronization, data changes, software running status, software resource usage, host hardware status, and network environment. It supports interface-based parameter configuration and customized data statistics, and can promptly issue abnormal alarms through various methods such as SMS, email, and customized interfaces, greatly improving work efficiency, reducing resource consumption, and saving operational costs.

DSG XCMP Data Comparison Platform provides different comparison strategies and methods for different application scenarios, including object comparison, data repair, object repair, scheduled comparison, and heterogeneous database comparison, to ensure data consistency.

Throughout the entire project, DSG has provided comprehensive technical support and services to the Agricultural Bank's fund clearing center. Firstly, ensuring that clients have free access to the new software licenses and corresponding upgrade services to keep their business in sync with the latest technology. Secondly, providing migration and maintenance services to help the Agricultural Bank smoothly complete system upgrades and migrations. In addition, DSG's online and offline technical support teams are available to assist clients with technical issues and provide solutions. For major drills and production changes, on-site and remote dual technical support is provided to ensure smooth business operations for clients. Even during major holidays, DSG's technical services remain uninterrupted, providing stable support to clients.

DSG is honored to be able to participate in the remote dual-center dual-active disaster recovery construction of the Agricultural Bank's fund clearing center and to receive high recognition from the client. We look forward to more opportunities for collaboration in the future, and to jointly promote the win-win development of digital construction!

Ending Easter eggs, do you know?

Extended sharing:

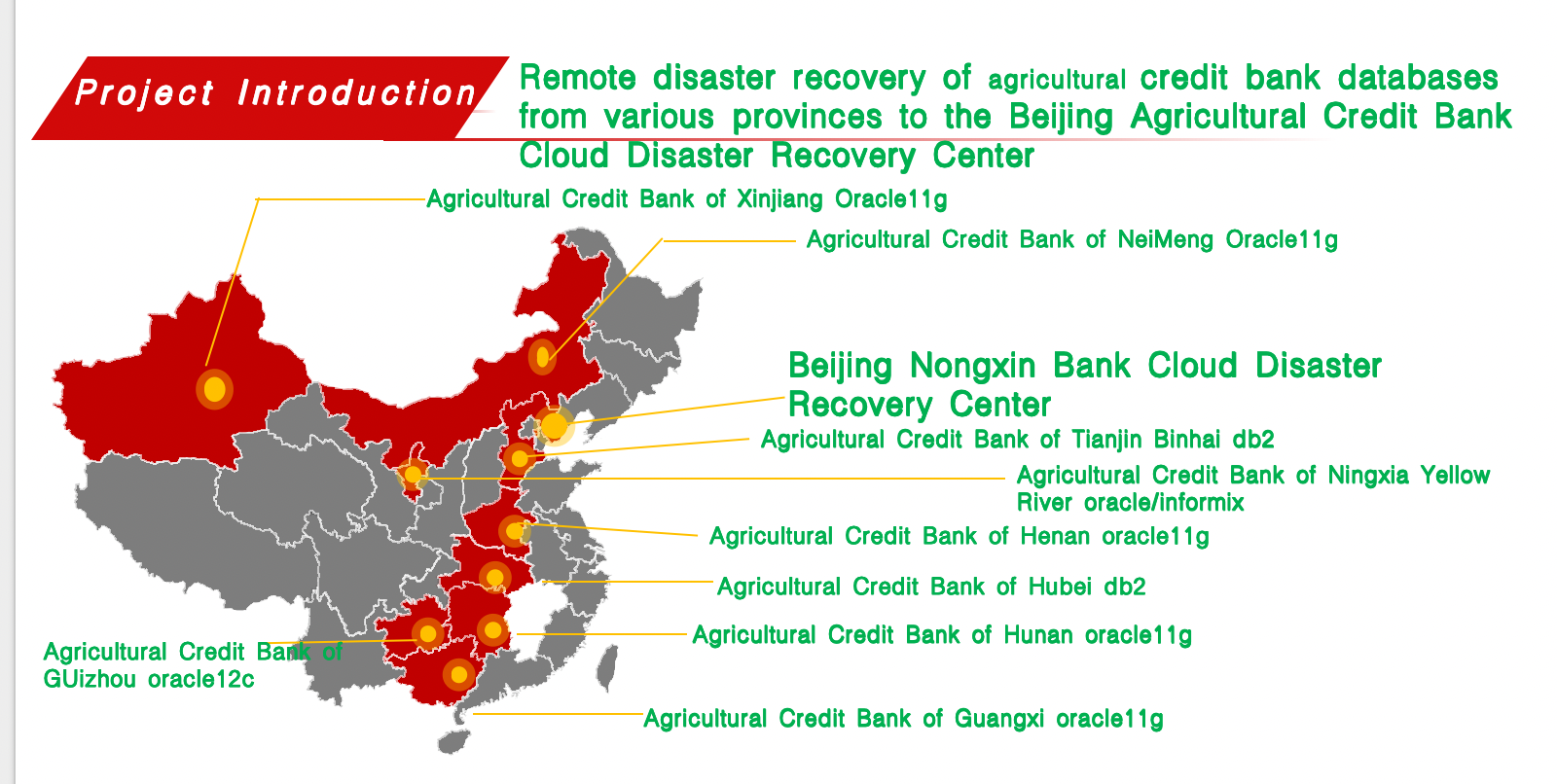

In recent years, DSG has assisted the remote disaster recovery of agricultural credit bank databases in multiple provinces and cities, including Xinjiang, Inner Mongolia, Tianjin, Ningxia, Henan, Hubei, Hunan, Guangxi, and Guizhou, to the Beijing Agricultural Credit Bank Cloud Disaster Recovery Center. The databases involved include DB2, Oracle11g, Oracle12c, Oracle19c, Informix, and more construction is still ongoing...

2024.05.16

Learn more>

2024.04.01

Learn more>

2024.03.25

Learn more>

2024.03.18

Learn more>

2024.03.04

Learn more>

2024.02.19

Learn more>

2024.02.04

Learn more>

2024.01.22

Learn more>

2024.01.15

Learn more>

2024.01.02

Learn more>

2023.12.25

Learn more>

2023.12.20

Learn more>

2023.12.11

Learn more>

2023.12.04

Learn more>

2023.11.20

Learn more>

2023.11.13

Learn more>

2023.11.06

Learn more>

2023.10.30

Learn more>

2023.10.11

Learn more>

2023.09.15

Learn more>

2023.08.01

Learn more>

2023.07.25

Learn more>

2023.07.04

Learn more>

2023.05.29

Learn more>

2023.05.08

Learn more>

2023.03.06

Learn more>

2022.12.28

Learn more>

2022.11.14

Learn more>

2022.09.26

Learn more>